Popular eBooks for Business Students

|

|

|

|

|

A Handbook of Human Resource Management Practice 10th Edition by Michael Armstrong, Pages 957This book introduces the general theory of relativity and includes applications to cosmology. The book provides a thorough introduction to tensor calculus and curved manifolds. After the necessary mathematical tools are introduced, the authors offer a thorough presentation of the theory of relativity. Also included are some advanced topics not previously covered by textbooks, including Kaluza-Klein theory, Israel's formalism and branes. Anisotropic cosmological models are also included. The book contains a large number of new exercises and examples, each with separate headings. The reader will benefit from an updated introduction to general relativity including the most recent developments in cosmology.

|

Advanced macroeconomics: Solutions manual, by Romer D., Pages 274Type: eBook Released: 1996 Publisher: MGH Page Count: 274 Format: djvu Free Software For Reading And Converting Language: English ISBN-10: 0070536686

|

Advanced Macroeconomics by David Romer, Pages 550Designed for graduate courses in macroeconomics, this important new text by a distinguished economist is the latest addition to McGraw-Hill's Advanced Series in Economics. The text is an introduction to the study of macroeconomics at an advanced level. Within each part, the major issues and competing theories are discussed. The presentation of theories is supplemented with examples of relevant empirical work as a way of illustrating how macroeconomics theories can be applied or tested. Each chapter concludes with an extensive set of problems.

|

Advances in Investment Analysis and Portfolio Management, Volume 8 byCheng-Few Lee, Pages 345Type: eBook Released: 2001 Publisher: JAI Press Page Count: 345 Format: pdf Software For Reading And Converting Language: English ISBN-10: 0762307986

|

Investment analysis and portfolio management by Frank K. Reilly, Keith C. Brown, Pages 1190

The purpose of this book is to help you learn how to manage your money to derive the maximum benefit from what you earn. Mixing investment instruments and capital markets with the theoretical detail on evaluating investments and opportunities to satisfy risk-return objectives along with how investment practice and theory is influenced by globalization leaves readers with the mindset on investments to serve them well. The material is intended to be rigorous and empirical yet not overly quantitative. We continue with unparalleled international coverage, newly rewritten and reorganized derivatives material to be more intuitive and clearer, three additional chapters on derivatives pricing for those who want more detail, rewritten material on multifactor models of risk and return, and new CFA problems for more practice on computations concerning investment decisions. To manage money and investments, one needs to learn about investment alternatives and develop a way of analyzing and thinking about investments that will be of benefit and allow a foundation as new tools and investment opportunities become available. Reilly/Brown provide the best foundation, used extensively by professionals, organizations, and schools across the country. A great source for those with both a theoretical and practical need for investment expertise.

About the Author

Professor Reilly received his BBA (Cum Laude), University of Notre Dame; MBA, Northwestern University; Ph.D. University of Chicago, and is a Chartered Financial Analyst (CFA). Dr. Reilly is the Bernard J. Hank Professor of Finance, Mendoza College of Business, University of Notre Dame. From 1981-1987, he was Dean of that College. Prior to 1981, Professor Reilly was a professor at the University of Illinois at Urbana-Champaign, the University of Wyoming, and the University of Kansas. He was included in the list of Outstanding Educators in America, received the Alumni Excellence in Graduate Teaching Award and the Outstanding Educator Award from the MBA class at the University of Illinois and the Outstanding Teachers Award from the MBA class at the University of Notre Dame, and the Faculty Award from the University of Notre Dame. Recently he was part of the inaugural group selected as a Fellow of the Financial Management Association International. At the 2001 AIMR annual meeting in Los Angeles, he received the Daniel J. Forrestal III Leadership Award for Professional Ethics and Standards of Investment Practice.

About the Author

Professor Reilly received his BBA (Cum Laude), University of Notre Dame; MBA, Northwestern University; Ph.D. University of Chicago, and is a Chartered Financial Analyst (CFA). Dr. Reilly is the Bernard J. Hank Professor of Finance, Mendoza College of Business, University of Notre Dame. From 1981-1987, he was Dean of that College. Prior to 1981, Professor Reilly was a professor at the University of Illinois at Urbana-Champaign, the University of Wyoming, and the University of Kansas. He was included in the list of Outstanding Educators in America, received the Alumni Excellence in Graduate Teaching Award and the Outstanding Educator Award from the MBA class at the University of Illinois and the Outstanding Teachers Award from the MBA class at the University of Notre Dame, and the Faculty Award from the University of Notre Dame. Recently he was part of the inaugural group selected as a Fellow of the Financial Management Association International. At the 2001 AIMR annual meeting in Los Angeles, he received the Daniel J. Forrestal III Leadership Award for Professional Ethics and Standards of Investment Practice.

Banking Principles and Practice by E. L. Stewart Patterson, Pages 300Edward Lloyd Stewart Patterson (1869- 1932) was a Canadian author. He was Superintendent of Eastern Township Branches, Canadian Bank of Commerce. His works include Banking Principles and Practice (1917). "It would be impossible within the narrow confines of one volume to deal exhaustively with so extensive a subject as that of Canadian banking practice, but it is hoped that the parts of this subject dealt with herein will be found to be treated with due regard to their relative importance, and that no really essential information has been overlooked. "

|

Essentials of Banking by Deborah K. Dilley, Pages 290

The essential guide for finance professionals in all industries for quick answers to banking questions, Essentials of Banking provides a nuts and bolts presentation explaining the regulatory, business, and people facts of the business of banking in a handy, concise format. It is the only guide you will need containing all the relevant facts of banking, all in one place.

From the Back Cover

The essential guide for finance professionals in allindustries for quick answers to banking questions. Essentials of Banking is designed with appreciation for demanding professional obligations, with information easy to find and at your fingertips. Its nuts and bolts presentation explains the regulatory, business, and people facts of the business of banking in a handy, concise format. Whether you are a teller in a bank located in a small agricultural community in the Midwest, a management trainee in a regional bank with offices throughout the Southeast, work in a bank that has locations across the United States and several foreign countries, or you are someone who simply needs to gain a better understanding of banking concepts, this book will introduce you to the world of banking by looking at the industry both from a historical and present day perspective. A practical resource for traditional bankers, online bankers, and finance professionals in any industry, Essentials of Banking provides you with an understanding of:

Deposit Insurance and the Regulatory Environment

Regulatory Compliance

The Business of Banking and the Bank Secrecy Act

An Introduction to Ethics

Customer Service

What Every Banker Needs to Know

How Cross-industry Affiliations May Significantly Change the Face of Banking

Examining how the focus in banking has shifted from a historical product-driven focus to a customer-driven focus and the ways in which banking is using multiple channels to service customers rather than relying solely on banking offices, Essentials of Banking is the only guide you will need containing all the relevant facts of banking, all in one place.

From the Back Cover

The essential guide for finance professionals in allindustries for quick answers to banking questions. Essentials of Banking is designed with appreciation for demanding professional obligations, with information easy to find and at your fingertips. Its nuts and bolts presentation explains the regulatory, business, and people facts of the business of banking in a handy, concise format. Whether you are a teller in a bank located in a small agricultural community in the Midwest, a management trainee in a regional bank with offices throughout the Southeast, work in a bank that has locations across the United States and several foreign countries, or you are someone who simply needs to gain a better understanding of banking concepts, this book will introduce you to the world of banking by looking at the industry both from a historical and present day perspective. A practical resource for traditional bankers, online bankers, and finance professionals in any industry, Essentials of Banking provides you with an understanding of:

Deposit Insurance and the Regulatory Environment

Regulatory Compliance

The Business of Banking and the Bank Secrecy Act

An Introduction to Ethics

Customer Service

What Every Banker Needs to Know

How Cross-industry Affiliations May Significantly Change the Face of Banking

Examining how the focus in banking has shifted from a historical product-driven focus to a customer-driven focus and the ways in which banking is using multiple channels to service customers rather than relying solely on banking offices, Essentials of Banking is the only guide you will need containing all the relevant facts of banking, all in one place.

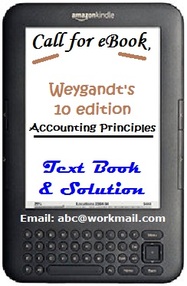

Call for the eBooks, you need

Our rich eBook Market will give you the opportunity to choice your need among 250,000 collection

Just drop your demand to: [email protected]